That is certainly why you might want to harness the engineering gain. Digitizing your interactions with shoppers and suppliers can make it much easier to meet purchaser expectations. Moreover, you may assure all of your crew users are conscious of any change in regulation and Keep to the updates.

You can integrate this possibility information and facts along with your individual purchaser and prospect data to enhance onboarding and screening effectiveness, safeguard your Firm’s name, and streamline your anti-revenue laundering and customer homework processes.

“IFRS 17 implementation has grown to be a crucial lever for modernizing and industrializing our actuarial procedures. We chose Moody’s solutions AXIS™ and RiskIntegrity™ for IFRS seventeen dependent on their own stability between out-of-the-box predefined framework and suppleness, which is able to aid us simplify the implementation and modeling of all our life insurance goods.”

Moody's aids underwriters pick out and screen the exceptional risks for his or her portfolios and aims with award-winning corporate entity knowledge, top-quality publicity details, global hazard context, insights on rising hazards, and sector-main science so they can selling price risk with self esteem. Our solutions boost underwriting throughput by automating workflows, providing in depth datasets for property and casualty lines of enterprise, and leveraging our high general performance, scalable, and cloud-native architecture.

Your Original enrollment period (IEP) is when you ought to sign up for Medicare should you don’t have any alternative protection (like wellness care by way of your employer). We’re all for declaring a birthday thirty day period, but the government wants to rejoice for 7! Your IEP commences three months in advance of

If the husband or wife has died, You will need to have already been married for at least nine months right before they passed away, and you have to get solitary now.

Life insurance Halt waiting months for knowledge. Improve the life insurance consumer practical experience and accelerate decision generating—without compromising risk assessment. Explain to me more

Our suite of tools covers actuarial and hazard modeling, asset-liability administration, organic catastrophe modeling, expenditure portfolio administration, underwriting portfolio management, and capital adequacy measurement and reporting. These equipment assist you to evaluate the appropriate risk variables below several scenarios for use in processes within the insurance worth chain which include pricing and underwriting, chance mitigation and solvency, and funds management.

Accumulating and examining knowledge from connected devices will allow insurers to make more customized and precise presents, resulting in bigger consumer Read it here satisfaction. Personalized policies that mirror specific behaviors and wishes make prospects come to feel understood, which may increase loyalty and retention.

Understand and Assess your own assets insurance portfolio and preserve regulatory compliance with potent info equipment and services.

Furthermore, above 80% of payroll audits are completed incorrectly. Both of those aspects impression your workers' payment protection.

The growing usage of electronic resources and services, together with the corresponding surge in info created from electronic interactions, has made technological innovation a crucial aggressive ability for insurance carriers.

Such collaborations usually tend to direct attempts successfully for the sources of business enterprise worth and at enterprise outcomes aligned into the institution’s General plans.

Don’t fret. It’s coming—when you receive close to the big six-5. Meanwhile, we’ll do our greatest to answer the issue Who's qualified for Medicare?

Neve Campbell Then & Now!

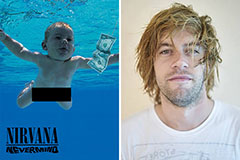

Neve Campbell Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Ross Bagley Then & Now!

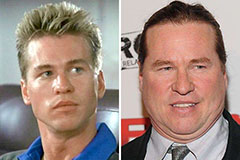

Ross Bagley Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!